Subject area: International business organization

Section 2.02 US : Corporate taxes 4

Section 2.03 US : Taxes for individuals 6

Article III. Staff & Employment 7

Section 3.01 The HR general legal framework 7

Section 3.02 Immigration and VISAs 9

Section 3.03 VISAs for non-American staff 9

Section 3.04 French employees status 13

Introduction

Exploring the American market as a French entrepreneur require to be careful on some points , like understanding the details of the culture and the laws when starting or buying a business in the USA. After detailing those two points in the first part, we will now focus on the next two important topics: taxes and immigration, especially the details of visas and working contracts. The United States is complex, and this essay only gives a brief overview.

In recent times, things have changed for French entrepreneurs in the United States. For instance, Treaty Trader (E-1) and Treaty Investor (E-2) Visas for French nationals have been extended from 25 to 48 months starting from November 16th, 2023. This means French business owners can stay longer, highlighting the important connection between immigration rules and business growth.

Understanding taxes is also really important. The Tax Cuts and Jobs Act (TCJA) in 2018 changed how businesses are taxed in the U.S., and it’s crucial for French entrepreneurs to know about it when dealing with the American market.

In the upcoming parts of this essay, we will go deeper into these important topics, stressing how crucial they are for French expats starting a business in the U.S. It is a bit challenging in a such short essay, but understanding those themes are keys to success.

Taxes

“Taxation is often used by governments as a strategic weapon to attract certain types of activity to the country, and to achieve certain economic objectives. However, these objectives may not be achieved if there is no tax cooperation between countries[1]”.

“To carry out their international activities, multinational companies generally set up directly controlled foreign subsidiaries, which are subject to the legislation (including taxation) of the countries in which they are located. In general, two different tax regimes are applied to the taxation of profits from international operations: some countries, such as the USA, Great Britain and Japan, tax the worldwide profits of resident companies, while others, such as France, apply a so-called “territorial” tax regime: France does not tax profits made outside the country.

Although US law taxes the worldwide profits of its nationals and companies, profits generated by operations carried out abroad are generally exempt. However, if such profits are invested abroad in good faith, taxation is deferred until the profits are repatriated to the United States, notably in the form of dividends.

In fact, deferred tax treatment applies only to profits earned by foreign subsidiaries. It does not apply to associations, partnerships and foreign branches related to U.S. companies; but with the exception of banks and insurance companies, foreign branches are rather rare. In addition, U.S. law does not allow deferred taxation of passive profits (known as “Subpart-F” profits), notably financial income and stock market capital gains earned abroad.

Countries such as the USA, which tax worldwide profits, attempt to mitigate the effects of multiple taxation of foreign profits, through a system of tax credits (albeit subject to considerable restrictions) for the amount of taxes paid to foreign governments[2].”

“To begin , we need to make the distinction between :

1 / U.S. and foreign taxpayers, and

2 / between U.S. and foreign profits. U.S. citizens (whether resident in the U.S. or not) and U.S. firms are all taxed under the worldwide profits regime. The same applies to resident aliens and anyone holding a work permit in the USA. Non-resident aliens and foreign corporations are taxed in the US only on profits that are US-sourced or deemed to have an effective relationship with a business activity or company in the US[3].”

In order to be able to determine in which case we are and then to be able to deal with the tax calculation itself, the tax treaty between the USA and France is a bilateral agreement between the two countries to settle any problems of double taxation that may arise due to the tax laws of the two nations. Here are some of the main ideas

Convention between the government of the USA and the government of the French republic .

-

-

- Article 1- Personal Scope

-

- “ This Convention shall apply only to persons who are residents of one or both of the Contracting States, except as otherwise provided in the Convention.[4]”

- Definition of a French resident

“You are domiciled in France for tax purposes if one of the following criteria is met:

- You have your home in France or, if you don’t have a home, your main place of residence.

- You have a salaried or self-employed professional activity in France, unless this activity is carried out on an ancillary basis.

- You have the center of your economic interests in France[5]”

- Definition of an American resident

- “If you are not a U.S. citizen, you are considered a nonresident of the United States for U.S. tax purposes unless you meet one of two tests. You are a resident of the United States for tax purposes if you meet either the green card test[6] or the substantial presence test for the calendar year[7] (January 1 – December 31 – For tax year N, if an individual was present in the United States for at least 31 days during year N and if the sum: (number of days present in year N-2 / 6) + (number of days present in year N-1 / 3) + (number of days present in year N) is greater than 183.[8]”

- Article 5 – Permanent Establishment

“1.For the purposes of this Convention, the term “permanent establishment” means a fixed place of business through which the business of an enterprise is wholly or partly carried on.

2. The term “permanent establishment” includes especially: (a) a place of management; (b) a branch; (c) an office; (d) a factory; (e) a workshop; and (f) a mine, an oil or gas well, a quarry, or any other place of extraction of natural resources.[9]”

- Article 7 – Business Profits

Profits are taxed where a company has a Permanent Establishment (PE). The country of the PE has the right to tax profits attributable to it. If no PE, the country of residence taxes the business profits[10].

- Article 9 – Associated Enterprises

- Transactions between associated enterprises should reflect arm’s length terms to determine profits.

Tax authorities can adjust profits if transactions between associated enterprises deviate from arm’s length terms. Countries engage in discussions to resolve transfer pricing disputes through the Mutual Agreement Procedure.[11]

- Article 10 – Taxation of Dividends

Dividends are taxed in the country of residence of the beneficial owner. The withholding tax rate on dividends is generally limited to 5% or 15%, depending on ownership. Dividends paid by a subsidiary to its parent company may be exempt from withholding tax.[12]

The purpose of the convention is to clarify any unclear or unqualified criteria in the two countries. In the case of a company considered stable, we will take a look at the different types of taxation applied in the USA.

US : Corporate taxes

Memo

|

American legal structures |

Main Taxes |

|

|

Branch |

||

|

Companies |

Corporation (or C-Corp) |

-Subject to corporate income tax at the federal and state levels. -The corporation itself is taxed, and shareholders are taxed on dividends received. |

|

Limited Liabi- lity Company (or LLC) |

By default, treated as a pass-through entity for tax purposes. Profits and losses pass through to individual members who report them on their personal tax returns. Individual income tax. Regulation Entity Classification Election” regulation, better known as the check the box rules. |

|

|

Sole Proprietorship (or “doing business as” DBA) |

For the DBA’s debts Taxation at owner level (individual income tax). |

|

|

Partnership |

General Partnership |

Pass-through entity. Profits and losses pass through to individual partners. |

|

Limited Liabi- lity Partnership (or LLP) |

Similar to a general partnership, but with some liability protection for individual partners. |

|

|

Co-companies |

Joint-venture |

Depends on the Legal form chosen ( corporation, or LLC, or partnership). |

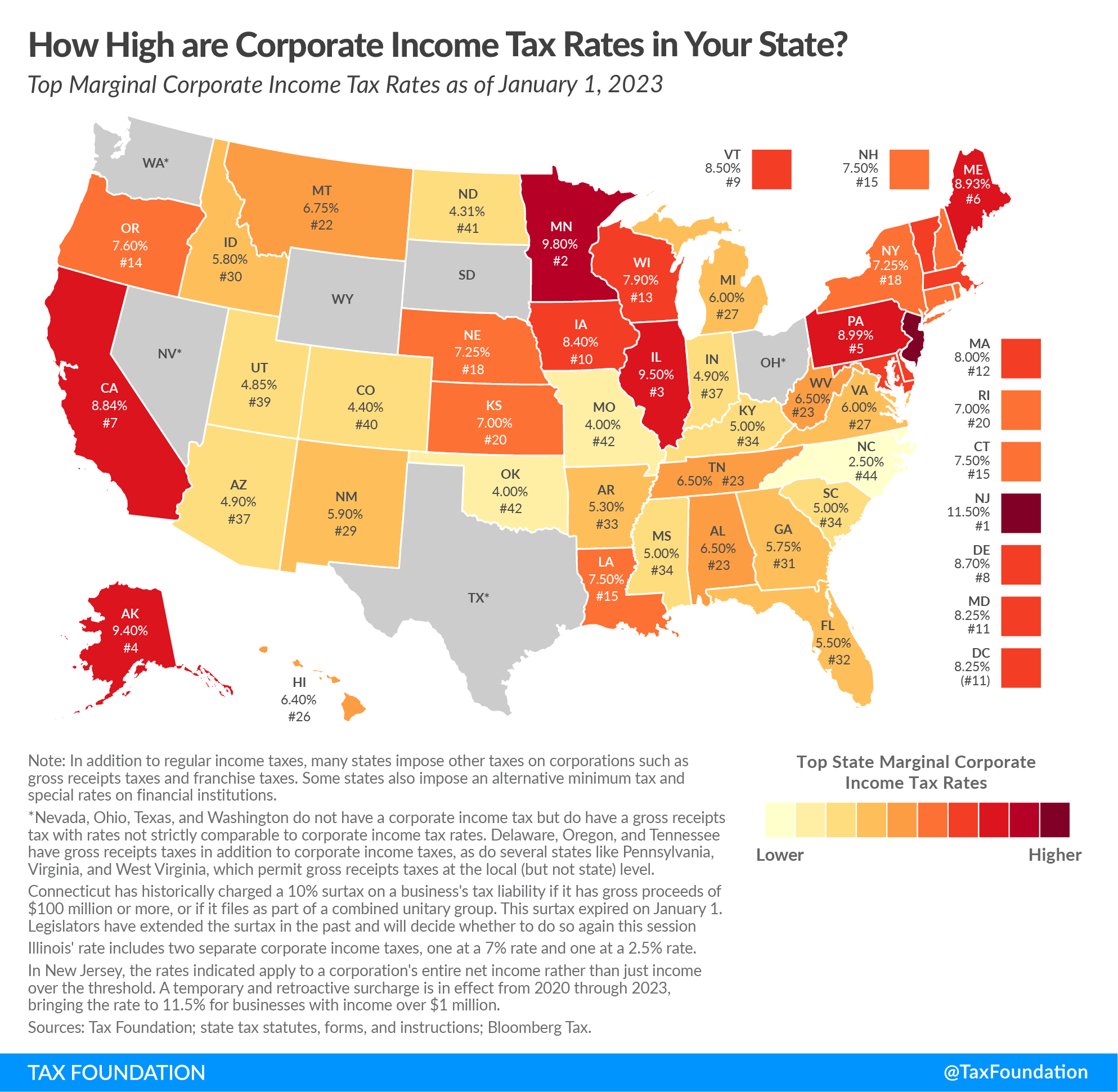

States Taxes

“ Each state is entitled to collect a tax on company profits, but only for the activity attributable to the state. Federal taxable income is apportioned among the various states where the company has a certificate to do business and a physical presence, on the basis of salaries paid, sales, fixed assets and rents paid.”

You may check all the corporate taxes per state here : https://taxadmin.org/state-tax-forms/

Federal taxes

The Tax Cuts and Jobs Act[13] (TCJA) of 2018 is a significant piece of U.S. tax legislation that introduced comprehensive changes to the corporate tax structure. One of the major highlights was the reduction of the corporate tax rate from 35% to 21%. This aimed to enhance the competitiveness of U.S. businesses globally.

If the company has foreign taxable activities, a tax credit is granted within the limits of the formula : tax credit = U.S. tax x foreign taxable income / worldwide taxable income.

Others taxes

Additionally, there are other taxes in the U.S., such as Sales and Use Tax (a consumption tax on goods and services) and Occupancy Tax (a levy on accommodations like hotels and rental properties). While not detailed here, it’s essential to consider their implications.

US : Taxes for individuals

States Taxes

All US residents are taxable on their worldwide income. Taxation of foreigners depends on whether they are residents or non-residents ( see section 2.01 ii ).

Individuals are subject to state and local income taxes. Rates in major cities vary widely, from 0% to 11%. If a taxpayer works in more than one state, he or she must pay taxes in the various states where he or she works, in proportion to the time worked.

A declaration in the state of residence is mandatory. If you are in this situation, your tax will be apportioned according to your Nexus, your “center of economic interest”.

|

2023 State Individual Income Tax Structures[14] |

||

|---|---|---|

|

States with No Income Tax |

States with a Flat Income Tax |

States with a Graduated-rate Income Tax |

|

Alaska |

Arizona |

Alabama |

|

Florida |

Colorado |

Arkansas |

|

Nevada |

Idaho |

California |

|

South Dakota |

Illinois |

Connecticut |

|

Tennessee |

Indiana |

Delaware |

|

Texas |

Kentucky |

Georgia |

|

Wyoming |

Michigan |

Hawaii |

|

Mississippi |

Iowa |

|

|

New Hampshire* |

Kansas |

|

|

North Carolina |

Louisiana |

|

|

Pennsylvania |

Maine |

|

|

Utah |

Maryland |

|

|

Washington** |

Massachusetts |

|

|

Minnesota |

||

|

Missouri |

||

|

Montana |

||

|

Nebraska |

||

|

New Jersey |

||

|

New Mexico |

||

|

New York |

||

|

North Dakota |

||

|

Ohio |

||

|

Oklahoma |

||

|

Oregon |

||

|

Rhode Island |

||

|

South Carolina |

||

|

Vermont |

||

|

Virginia |

||

|

West Virginia |

||

|

Wisconsin |

||

|

District of Columbia |

||

Federal taxes

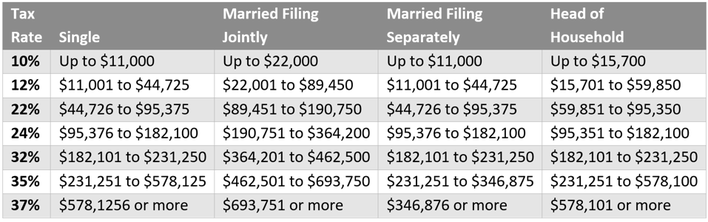

You can fill in your tax return online on the IRS website, and the procedure is quick and easy. Tax brackets vary according to family situation (there is no family quotient system as in France).

To calculate your federal tax liability, you need to determine your Adjusted Gross Income (AGI). This is equal to the sum of your income minus deductible investments and expenses.

You can invest in a pension fund and deduct it from your income if you don’t have a company pension fund. Certain expenses can also be deducted from your overall income, such as moving expenses, contributions to medical funds or annuities[15].

The tax year 2023 adjustments described below generally apply to tax returns filed in 2024.

The tax items for tax year 2023 of greatest interest to most taxpayers include the following dollar amounts: The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.[16] [17]

Having now a global overview on the complex landscape of federal and state taxation for businesses and individuals, let me now bring your attention towards another critical facet, with a specific focus on international mobility for French investors: immigration law. Our exploration will delve into essential aspects, including visas, employment contracts, and pertinent legal frameworks governing immigration in the United States.

Staff & Employment

The HR general legal framework

Overview

“The American legal framework surrounding the employment relationship is complex, due to the diversity of legal sources (federal, state and case law) and the multiplication of company agreements in certain sectors of the economy (see “Union representation” below). In order to understand his rights and obligations, the employer needs to be aware of both federal and state rules.

Federal legislation lays down the main principles applicable to labor relations.

Applicable throughout the U.S., these principles guarantee employees the minimum protection that all employers are required to provide. Federal agencies monitor compliance with these rules.

These texts leave the states a great deal of latitude when it comes to introducing state legislation that is more favorable to employees. Virtually all states have their own rules on discrimination, dismissal, wages and working hours, employer liability for damage caused by employees and, of course, taxation and social security contributions. Each state has its own specialized employment authority.

Jurisprudence is an important law source in a Common Law system in that, furthermore than a tool for interpreting statutes, is a law creator. Mastering and studying case law in the United States is made difficult by the existence of two parallel legal and judicial systems. Disputes between employers and employees can be brought either before the state courts, or before the federal courts under federal and/or state law. As a result, it is imperative for employers to be familiar with and comply with the ever-changing and particularly complex case law[18].”

“The common law viewed the employment relationship basically as one of “employment at will,”parties are free to contract and free to terminate. Over time, contractual and statutory provisions and rules have limited this system of “hire and fire.” Thus, it may not be possible to terminate an employee freely “at will.” Instead, the consideration-doctrine (supra-No. 300 et seq.) may apply: an employee will agree to the termination (provide the employer with a release of his claims), which the employer “buys” by furnishing consideration in the form of a one-time payment (severance pay). Procedures and mechanisms for a termination will be a subject in the contract of employment.[19]”[20]

Main employment laws

Certain employment laws in the U.S. are imperative to comprehend and adhere to. The subsequent aspects are intricately tied to the history and culture of the U.S. Familiarity with these regulations is essential to prevent issues or legal challenges with employees.

- Salary.

- Descrimination. The equal employment Opportunity Commission take care of of the application of laws to avoid discrimination based on (non-exhaustive list) :

- Welfare.

- Family and Medical Leave Act[28] : Allows eligible employees to take unpaid, job-protected leave for specific family or medical reasons.

- Occupational Safety and Health Act[29] of 1970: Ensures safe and healthy working conditions by setting and enforcing standards.

- The Affordable Care Act[30] requires certain employers to offer health insurance to their employees. It is also interesting to understand the Social Security Act Of 1935[31].

The laws and fundamental principles outlined in the aforementioned texts are applicable to all personnel. Nevertheless, as an investor, and for all non-American individuals, whether French or otherwise, lacking a green card or equivalent permit, immigration procedures must be pursued to secure legal authorization for working on U.S. soil. The following are the primary avenues for such endeavors.

Immigration and VISAs

The U.S. immigration authorities are the U.S. consulates in France, which report to the Department of State (DOS), and the U.S. Citizenship and Immigration Services (USCIS). USCIS is a government agency attached to the Department of Homeland Security (DHS), replacing the Immigration and Naturalization Service (INS). USCIS operates exclusively within the U.S. and has jurisdiction over extensions of stay and changes of status but does not issue visas.

“As a general rule[32], foreigners who are not in possession of a permanent resident permit (green card) require a visa to enter the United States. They must obtain a visa from the American Embassy or Consulate in their home country. Prerequisites differ in relation to immigrant and non-immigrant foreigners. Non-immigrants are foreign government officials, employees, officials of international organizations, tourists, students, exchange visitors, so-called “treaty traders and investors” (covered by international agreements with their respective countries), travellers in transit, seasonal workers, and seamen. Traditionally, non-immigrant visas were issued speedily, but following the terrorist attacks in 2001, they have become more difficult for non-citizens to procure.

As a rule, visas require proof of sufficient financial means to cover the period of stay and return travel. While these visas are limited in time, they can often be extended. Possession of a visa is not a guarantee of actual permission to enter. Permission is given at the time of entry by an official from the U.S. Citizenship and Immigration Services (USCIS[33]) upon examination of the visa and possible review of satisfaction of the preconditions for its issuance[34]. If a traveller is denied admission, he is entitled to the protections afforded by law, including legal remedies[35].

The issuance of immigrant visas is based on a quota system and may thus entail waiting periods of different lengths[36].There are preferences for particular categories of persons, such as people with particular skills.Certain persons are ineligible to receive visas, such as: the mentally ill, persons with criminal records, present or former members of designated organizations and/or parties, and persons who are deemed to present a financial or security risk[37].”[38]

VISAs for non-American staff

You can find all VISAs on the following link : https://travel.state.gov/content/travel/en/us-visas/visa-information-resources/all-visa-categories.html .

I picked only the most accurate to our topic.

|

Visa |

Who is concerned? |

Duration[39] & statue & Fees |

Conditions |

Limitations |

|

Visa Waiver Program |

The Visa Waiver Program allows citizens of participating countries to travel to the U.S. for tourism or business for up to 90 days without a visa. |

Not a VISA $21 Your ESTA authorization is generally valid for multiple trips over a period of two years you may only stay for up to 90 days at a time and there should be a reasonable amount of time between visits. |

-Intend to enter the United States for 90 days or less for business, pleasure or transit -Have a valid passport lawfully issued to you by a Visa Waiver Program country -Arrive via a Visa Waiver Program signatory carrier -Have a return or onward ticket Travel does not terminate in contiguous territory or adjacent islands unless the traveler is a resident of one of those areas -Are a citizen or national of one of the Visa Waiver Program countries listed |

-If you intend to arrive in the United States aboard a non-signatory air carrier. -If you intend to visit the United States for more than 90 days. -If you believe any grounds of inadmissibility of the Immigration and Nationality Act § 212(a) apply to you, you should apply for a nonimmigrant visa before traveling to the United States. -If you are traveling to the United States for a purpose other than short-term tourism or business. |

|

Visitor Visa B1 Business[42] |

Visitor visas are nonimmigrant visas for persons who want to enter the United States temporarily for business -Consult with business associates -Attend a scientific, educational, professional, or business convention or conference -Settle an estate -Negotiate a contract |

Nonimmigrant Visa Categorie $185 The US business visa comes with a validity period of 10 years. It allows a French citizen to stay in the country for 180 days per entry. |

-Passport valid for travel to the United States -Nonimmigrant Visa Application, Form DS-160 confirmation page. -Application fee payment receipt, if you are required to pay before your interview. -Photo |

-Study -Employment -Paid performances, or any professional performance before a paying audience -Arrival as a crewmember on a ship or aircraft -Work as foreign press, in radio, film, print journalism, or other information media -Permanent residence in the United States |

|

Treaty Trader & Investor Visas Treaty Trader (E-1), Treaty Investor (E-2) E1 – E2[43] |

Treaty Trader (E-1), Treaty Investor (E-2) visas are for citizens of countries with which the United States maintains treaties of commerce and navigation. -Engage in substantial trade, including trade in services or technology, in qualifying activities, principally between the United States and the treaty country; -Develop and direct the operations of an enterprise in which you have invested a substantial amount of capital |

Nonimmigrant Visa Categorie $315 Beginning on November 16th, 2023, Treaty Trader (E-1) and Treaty Investor (E-2) Visas for French nationals will be issued for 48 months, an increase from the previous validity of 25 months. A reciprocity fee of $58 per approved visa will be charged at the time of the interview. |

E1 -You must be a citizen of a treaty country. -The trading firm for which you plan to come to the United States must have the nationality of the treaty country, meaning persons with the treaty country’s nationality must own at least 50 percent of the enterprise. -The international trade must be substantial, meaning that there is a sizable and continuing volume of trade. -More than 50 percent of the international trade involved must be between the United States and the treaty country. -Trade means the international exchange of goods, services, and technology. Title of the trade items must pass from one party to the other. E2 -The investor, either a person, partnership or corporate entity, must have the citizenship of a treaty country. -If a business, at least 50 percent of the business must be owned by persons with the treaty country’s nationality. -The investment must be substantial, with investment funds or assets committed and irrevocable. It must be sufficient to ensure the successful operation of the enterprise. -The investment must be a real operating enterprise, an active commercial or entrepreneurial undertaking. A paper organization, speculative or idle investment does not qualify. -It must generate significantly more income than just to provide a living to you and family, or it must have a significant economic impact in the United States. |

E1 -You must be an essential employee, employed in a supervisory or executive capacity, or possess highly specialized skills essential to the efficient operation of the firm. Ordinary skilled or unskilled workers do not qualify. E2 -Uncommitted funds in a bank account or similar security are not considered an investment. -You must have control of the funds, and the investment must be at risk in the commercial sense. Loans secured with the assets of the investment enterprise are not allowed. -You must be coming to the United States to develop and direct the enterprise. If you are not the principal investor, you must be considered an essential employee, employed in a supervisory, executive, or highly specialized skill capacity. -Ordinary skilled and unskilled workers do not qualify. |

|

Employment First Preference (E1): Priority Worker and Persons of Extraordinary Ability Employment Second Preference (E2): Professionals Holding Advanced Degrees and Persons of Exceptional Ability E1 E2 [44] |

E1 – Persons with extraordinary ability in the sciences, arts, education, business, or athletics. -Outstanding professors and researchers with at least three years experience in teaching or research, who are recognized internationally. -Multinational managers or executives who have been employed for at least one of the three preceding years by the overseas affiliate, parent, subsidiary, or branch of the U.S. employer. The applicant’s employment outside of the U.S. must have been in a managerial or executive capacity, and the applicant must be coming to work in a managerial or executive capacity. E2 -Professionals holding an advanced degree (beyond a baccalaureate degree), or a baccalaureate degree and at least five years progressive experience in the profession. -Persons with exceptional ability in the sciences, arts, or business. Exceptional ability means having a degree of expertise significantly above that ordinarily encountered in the sciences, arts, or business. |

Employment-Based Immigrant Visas $345 48 Months |

-Passport(s) valid for six months beyond the intended date of entry into the United States, unless longer validity is specifically requested by the U.S. -Form DS-260, Immigrant Visa and Alien Registration -Two (2) 2×2 photographs – Civil Documents for the applicant. -Financial Support – Completed Medical Examination Forms |

-Did not fully complete the visa application and/or provide all required supporting documentation -Was convicted of a crime involving moral turpitude – Skilled Workers, Professionals, and Unskilled Workers (Other Workers) receive 28.6 percent of the yearly worldwide limit of employment-based immigrant visas, plus any unused visas from the Employment First Preference and Second Preference categories. |

|

Temporary Worker Visas Intra-company transferee L[45] |

To work at a branch, parent, affiliate, or subsidiary of the current employer in a managerial or executive capacity, or in a position requiring specialized knowledge. Individual must have been employed by the same employer abroad continuously for 1 year within the three preceding years. |

Nonimmigrant Visa Categorie No fees 17 Months |

-Passport valid for travel to the United States -Nonimmigrant Visa Application, Form DS-160 confirmation page. -Application fee payment receipt, if you are required to pay before your interview. -Photo -Receipt Number -L Visa Applicants – If you are included in an L blanket petition, you must bring Form I-129S, Nonimmigrant Petition Based on Blanket L Petition, to your interview. |

-The employer must file a Form I-129 for a Nonimmigrant Worker, with fee, on behalf of the employee. -Even if the French company has no pre-existing subsidiary in the U.S., executives or employees can be transferred to the U.S. on an L-1 visa to open a new office. In this case, the initial duration of the visa is only one year (instead of three years if a subsidiary is already established). – Unlike E visas, the employee does not have to be of the same nationality as the company. |

|

Temporary Worker Visas Person in Specialty Occupation H1B[46] |

To work in a specialty occupation. Requires a higher education degree or its equivalent. Includes fashion models of distinguished merit and ability and government-to-government research and development, or co-production projects administered by the Department of Defense. |

Nonimmigrant Visa Categorie $465.00 36 Months |

-Passport valid for travel to the United States -Nonimmigrant Visa Application, Form DS-160 confirmation page. -Application fee payment receipt, if you are required to pay before your interview. -Photo -Receipt Number |

-The employer must file a Form I-129, Petition for a Nonimmigrant Worker, with fee, on behalf of the employee. -The USCIS stated that it has received a sufficient number of petitions to meet both the regular cap of 65,000.H-1B visas for fiscal year 2024 have been exhausted. |

We have now examined the most suitable visas for the establishment of a branch or subsidiary by French nationals in the United States. Even if the status of the transferred individuals is in compliance with U.S. regulations, there are also procedures to be completed in France.

French employees status

Posted employee abroad[47]

1/What is a posted employee abroad?

A posted employee is sent abroad by their original employer for a specific period.

2/Is the employment contract maintained during the posting?

As a posted employee, you remain part of your French employer’s workforce. An addendum formalizes the posting, addressing relationships with the French employer and the host company, determining applicable laws, assessing tax implications, and outlining reintegration after the mission.

3/What are the tax consequences of a posting?

The original employer must assist in defining the tax status in the host country, as the departure may affect tax residency. Depending on the case, the salary may be subject to taxation in the host country.

4/Does the posted employee continue to benefit from social protection?

For postings exceeding 3 months in non-EU countries or countries outside the Schengen Area or Switzerland, employers need to request a posting certificate online. The employer must fill out a questionnaire for workers under the agricultural regime and submit it to the relevant social security institution. The benefit is temporary, typically lasting up to 3 years, renewable once.

Expatriate employee abroad[48]

1/Who qualifies as an expatriate employee?

Expatriate status applies to any employee working outside France for at least 3 months. They are relieved from compliance with their original company’s requirements.

2/What’s the contract for an expatriate abroad?

It varies based on direct foreign employment or being recruited by a French company for a foreign entity, involving either suspension or termination of the original contract.

3/What are the tax obligations for a French expatriate?

Taxation may continue if the family stays in France or income is received from French sources. Non-residents might be subject to certain taxes.

4/What’s the social protection for an expatriate?

Affiliation with the host country’s social protection is standard. Optional French health insurance via Caisse des Français de l’étranger (CFE) is available for sickness, maternity, and more.

Conclusion

To conclude, navigating the complexities of establishing and expanding a French business in the United States involves a strategic understanding of taxation and immigration laws. The insights provided in this essay, particularly in the second part, shed light on the importance of these aspects for French expatriates venturing into the American market.

The extension of Treaty Trader and Treaty Investor Visas for French nationals emphasizes the evolving nature of immigration policies and their direct impact on the ability of French business owners to establish a lasting presence in the U.S. This regulatory change underscores the interdependence of immigration rules and business development.

Moreover, the Tax Cuts and Jobs Act (TCJA) of 2018 has significantly altered the landscape of corporate taxes in the U.S. French entrepreneurs must be cognizant of these changes, as fiscal understanding is fundamental to navigating the intricacies of the American business environment.

In light of the enduring alliance between the United States and France, underlined by shared values and historical collaboration, the collaborative partnership extends beyond military and political realms to economic cooperation. The robust trade and investment relationship between the two nations highlights the substantial opportunities for French businesses in the U.S. market.

As French entrepreneurs embark on this journey, a holistic comprehension of the tax landscape and immigration regulations will be instrumental in ensuring the success and longevity of their ventures in the United States.

-

Fiscalité et stratégie d’entreprise – Myron S Scholes Mark A Wolfson – Gestion fiscale internationale – p297 ↑

-

Fiscalité et stratégie d’entreprise – Myron S Scholes Mark A Wolfson – Gestion fiscale internationale – p295-296 ↑

-

Fiscalité et stratégie d’entreprise – Myron S Scholes Mark A Wolfson – Gestion fiscale internationale – p299 ↑

-

https://www.impots.gouv.fr/resident-de-france#:~:text=Que%20signifie%20%C3%AAtre%20r%C3%A9sident%20fiscal,consid%C3%A9r%C3%A9e%20comme%20r%C3%A9sidente%20de%20France ↑

-

https://www.irs.gov/individuals/international-taxpayers/determining-an-individuals-tax-residency-status ↑

-

https://www.irs.gov/individuals/international-taxpayers/substantial-presence-test ↑

-

https://www.irs.gov/individuals/international-taxpayers/taxation-of-us-residents ↑

-

https://www.irs.gov/pub/irs-trty/france.pdf Article 5 ↑

-

https://www.irs.gov/pub/irs-trty/france.pdf Article 7 ↑

-

https://www.irs.gov/pub/irs-trty/france.pdf Article 9 ↑

-

https://www.irs.gov/pub/irs-trty/france.pdf Article 10 ↑

-

https://www.irs.gov/newsroom/tax-cuts-and-jobs-act-a-comparison-for-businesses ↑

-

https://taxfoundation.org/data/all/state/state-income-tax-rates-2023/

Note: *Applies to interest and dividends income only. **Applies to capital gains income of high-earners. ↑

-

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023 ↑

-

https://www.forbes.com/sites/markkantrowitz/2022/11/22/new-2023-irs-income-tax-brackets-and-phaseouts/ ↑

-

S’implanter aux Etats-Unis – Hervé Ochsenbein P176 – La gestion des ressources humaines ↑

-

Lapeer Foundry & Machine inc, 289 N.L.R.B 952 (1988). ↑

-

Law of the United States – 3rd edition – Introduction au droit Americain – Peter Hay p 291-292 Ch6 – Texte 666 ↑

-

https://www.dol.gov/sites/dolgov/files/WHD/legacy/files/FairLaborStandAct.pdf ↑

-

https://www.eeoc.gov/statutes/title-vii-civil-rights-act-1964 ↑

-

https://www.dol.gov/agencies/oasam/centers-offices/civil-rights-center/internal/policies/age-discrimination ↑

-

https://www.archives.gov/milestone-documents/social-security-act ↑

-

An exemption may apply to citizens of certain countries wishing to enter the United States for a temporary stay (excluding employment). 8 U.S.C. § 1187 (2004). The exemption applies to citizens of the European Union (with the exception of Greece), as well as others. ↑

-

The Homeland Security Act of 2002, Pub. L. No. 107-296, 116 Stat. 2135 (2002) eliminated the Immigration and the Naturalization Service (INS) and transferred the functions formerly performed by the INS to oversight by the Department of Homeland Security. Under this regime, the different responsibilities formerly entrusted to the INS are dissected and subject to differing controls. For example, immigration enforcement functions are under the control of the Directorate of Border and Transportation Security, immigration service functions are under the umbrella of the U.S. Citizenship and Immigration Services, and other immigration functions report to selected officials within the Department of Homeland Security. ↑

-

Foreigners from all but 27 nations who enter the United States through airports or seaports must have their fingerprints scanned and their photographs taken as a precondition to entry as part of an effort to tighten border security control. See Exec. Order No. 13323, 69 Fed. Reg. 482 (Jan. 5, 2004). ↑

-

See Brownell v. We Shung, 352 U.S. 180, 77 S.Ct. 252, 1 L.Ed.2d 225 (1956). ↑

-

The quota system does not apply to some categories of persons, for instance, family members of U.S. citizens. ↑

-

8 U.S.C. § 1182 (a)(1) – (4). ↑

-

Law of the United States – 3rd edition – Introduction au droit Americain – Peter Hay p 39-40 Ch2 – Texte 74-75 ↑

-

https://travel.state.gov/content/travel/en/us-visas/Visa-Reciprocity-and-Civil-Documents-by-Country/France.html ↑

-

https://travel.state.gov/content/travel/en/us-visas/tourism-visit/visitor.html ↑

-

https://travel.state.gov/content/travel/en/us-visas/employment/treaty-trader-investor-visa-e.html ↑

-

https://travel.state.gov/content/travel/en/us-visas/immigrate/employment-based-immigrant-visas.html ↑

-

https://www.uscis.gov/working-in-the-united-states/temporary-workers/l-1a-intracompany-transferee-executive-or-manager ↑

-

https://travel.state.gov/content/travel/en/us-visas/employment/temporary-worker-visas.html ↑

-

https://www.service-public.fr/particuliers/vosdroits/F3155 ↑